Welcome to our detailed guide on the Top 10 Features of Huntington Online Banking You Should Know!

In today’s fast-paced world, managing your finances efficiently is more important than ever. Whether you’re paying bills, transferring money, or keeping track of your expenses, having access to a reliable online banking platform can make your life much easier. This is where Huntington Bank truly shines.

Huntington Bank is one of the most trusted financial institutions in the United States, known for its strong commitment to customer satisfaction and innovative banking solutions. Its online banking platform, designed with convenience and security in mind, brings banking services directly to your fingertips, making it accessible anytime, anywhere.

But what makes Huntington Online Banking stand out from the rest? It’s not just about logging in to check your balance or make payments. It’s about discovering a range of features that simplify your financial management and help you make smarter financial decisions.

This article is your roadmap to uncovering the most useful and powerful tools Huntington Online Banking offers. From personalized account insights to advanced security features, these tools are designed to save you time, offer peace of mind, and enhance your overall banking experience.

By understanding and utilizing these features, you can transform the way you bank online and maximize the benefits of your Huntington Bank account. So, let’s dive in and explore how these features can make managing your money not only simpler but also more rewarding.

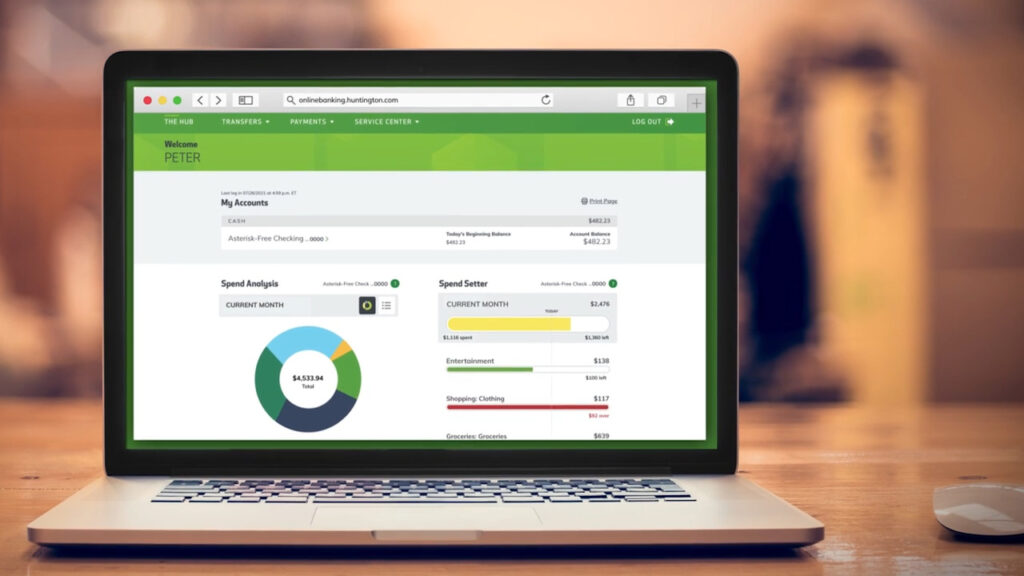

Feature 1: Intuitive Dashboard

Managing your finances can feel overwhelming, especially when you have multiple accounts, bills, and transactions to keep track of. That’s where the Intuitive Dashboard of Huntington Online Banking comes in. This feature is designed to simplify your online banking experience by putting everything you need in one easily accessible place.

Whether you’re checking balances, tracking your spending, or preparing for upcoming payments, the dashboard ensures you have all the tools to stay in control of your finances.

Streamlined Access to Banking Information

The first thing you’ll notice about Huntington’s online banking platform is its streamlined and user-friendly design. The dashboard acts as your central hub, displaying all the essential details you need to manage your accounts effectively.

At a glance, you can check your current account balances, review recent transactions, and monitor upcoming bill payments. There’s no need to navigate through multiple menus or search for the information you need—it’s all laid out clearly and concisely.

Also Read : Atmos Energy: Your 2025 Partner in Sustainable Living

This feature is particularly helpful for busy individuals who don’t have the time to dig through complex banking apps. Whether you’re logging in on your laptop or using the mobile app, the dashboard offers the same level of accessibility and clarity. With Huntington Online Banking, you can make better financial decisions faster and with greater confidence.

Customizable Layout for Personalization

One of the most powerful aspects of the Intuitive Dashboard is its ability to adapt to your unique needs. The dashboard layout is fully customizable, allowing you to prioritize the features and information that matter most to you.

For instance, if your primary focus is saving for a specific goal, you can position your savings account details at the top of the screen. Similarly, if tracking upcoming bills is a priority, you can configure the dashboard to display payment reminders prominently.

This level of customization ensures that your banking experience is not only efficient but also tailored to your lifestyle. By putting you in control of how your dashboard looks and operates, Huntington Bank makes managing your finances a seamless and stress-free process. It’s like having a personal assistant that keeps your financial priorities front and center every time you log in.

User-Friendly Design for All Levels of Experience

Whether you’re tech-savvy or new to online banking, the Intuitive Dashboard ensures an effortless experience for all users. The platform is designed with simplicity in mind, offering a clean and uncluttered interface that anyone can navigate. Even if it’s your first time using an online banking system, Huntington Bank’s intuitive design minimizes the learning curve.

Key information is displayed in clearly labeled sections, and helpful tooltips guide you through unfamiliar features. The mobile app mirrors the desktop dashboard’s functionality, so you can enjoy the same user-friendly experience on the go.

This thoughtful design approach reflects Huntington Bank’s commitment to making online banking accessible to everyone, regardless of their technical expertise.

Why the Intuitive Dashboard Matters

A well-designed dashboard isn’t just about convenience—it’s about empowering users to take full control of their finances. Huntington Bank understands that every customer has unique needs, and the Intuitive Dashboard caters to those needs by providing quick access to essential tools and information.

By simplifying complex processes and presenting data in an easy-to-digest format, the dashboard helps you make informed financial decisions with minimal effort.

Imagine logging in to your online banking account and immediately seeing everything you need: your current balance, a list of recent transactions, and alerts for upcoming payments.

This clarity and organization save time and reduce stress, allowing you to focus on your financial goals instead of getting bogged down by confusing menus or excessive information.

Key Features at a Glance

- Quick Access: Instantly view account balances, transaction history, and upcoming bill reminders without navigating through multiple screens.

- Customizable Layout: Tailor the dashboard to prioritize the features and information that are most important to you.

- Ease of Use: Navigate with confidence, thanks to a straightforward and user-friendly interface designed for everyone.

The Intuitive Dashboard is more than just a feature—it’s the heart of the Huntington Online Banking experience. By combining accessibility, customization, and simplicity, this feature ensures that managing your finances becomes a task you look forward to, rather than something you dread.

Feature 2: Mobile App

In today’s world, having the ability to manage your finances on the go is crucial, and Huntington’s Mobile App makes that possible with ease. Whether you’re on a lunch break, commuting, or simply away from your computer, the Huntington Mobile App for iOS and Android devices allows you to securely access your accounts and perform banking tasks anytime, anywhere.

Access Your Accounts Anytime, Anywhere

Gone are the days of having to sit down at your computer to check balances or make transfers. With Huntington’s Mobile App, everything you need is available right in the palm of your hand.

The app is designed to be intuitive and easy to use, allowing you to manage your finances from your smartphone or tablet. You can check account balances, review transaction history, and transfer funds between accounts in just a few taps.

Also Read : The Mummers Parade 2025 – learn the Cultural Significances

Whether you’re at home, on the road, or traveling abroad, the Huntington Mobile App ensures that your banking is as flexible as your lifestyle. You won’t have to worry about missing a payment or forgetting to check your balance—you’ll always have access to the information you need, right at your fingertips.

Convenient Features for Busy Lifestyles

For those with busy schedules, the Huntington Mobile App offers several convenient features that help you stay on top of your finances. One of the most popular tools is mobile check deposit, which allows you to deposit checks without having to visit a branch. Simply snap a photo of the check with your phone’s camera, and the app will process the deposit securely.

Additionally, the app provides bill pay functionality, so you can easily manage and schedule payments to ensure you never miss a due date. This feature streamlines the bill payment process, making it fast and efficient without needing to log into separate biller websites.

Enhanced Security Features

When it comes to mobile banking, security is paramount, and Huntington’s Mobile App takes your safety seriously. The app includes fingerprint and facial recognition login, which makes signing in both fast and secure.

This feature allows you to log in to your account with a simple scan of your fingerprint or a quick face scan, providing an added layer of protection against unauthorized access.

Moreover, Huntington Bank implements encryption and other advanced security protocols to ensure your sensitive information remains safe while you’re banking on the go. These features give you peace of mind, knowing that your transactions and data are protected every time you use the app.

Why It Matters

In today’s fast-paced world, having mobile access to your finances is more than just a convenience—it’s essential. Whether you’re managing your daily expenses or handling larger financial transactions, the Huntington Mobile App gives you the flexibility to do so whenever and wherever you are.

With its secure login features and practical tools like mobile check deposit and bill pay, the app takes the stress out of managing your accounts on the go.

Key Features at a Glance

- Mobile Check Deposit: Deposit checks from anywhere with a quick photo.

- Bill Pay: Schedule and pay bills on time directly from the app.

- Secure Login: Use fingerprint or facial recognition for added protection.

- Access Anytime: Manage your accounts and complete transactions on the go.

The Huntington Mobile App is the perfect solution for those who want to take their banking experience to the next level, offering convenience, security, and flexibility all in one.

Feature 3: Bill Pay

Managing bills can be one of the most tedious parts of personal finance, but Huntington Online Banking’s Bill Pay feature makes it easy and stress-free. Whether it’s your monthly utilities, credit card bills, or subscription services, you can manage all your recurring bills in one convenient place.

By using the Bill Pay feature in Huntington Online Banking, you can automate the process, stay on top of payments, and save time—all while avoiding late fees and missed payments.

Seamless Bill Payment Experience with Huntington Online Banking

The Bill Pay feature of Huntington Online Banking ensures a smooth and simple process for paying all of your bills. Once you set up your bills and payees, you can quickly and easily make payments with just a few clicks.

Also Read : 10 Career Milestones of Alejandra Espinoza You Should Know

The Huntington Online Banking platform allows you to view all your upcoming payments, check the due dates, and take action in one place—no more scrambling to remember deadlines or logging into multiple sites.

Instead of manually writing checks or logging into each service’s website, Huntington Online Banking’s Bill Pay allows you to take control of your payments directly through the online banking platform. Whether it’s paying your rent, credit card, or utility bills, everything can be tracked and managed in one spot.

Scheduled and Automatic Payments through Huntington Online Banking

One of the best features of Huntington Online Banking’s Bill Pay is the ability to schedule payments in advance. This allows you to plan and manage your payments well before their due dates.

You can set up automatic payments so your bills are paid on time every month without you having to remember each one. This option is especially helpful for bills that have fixed due dates, such as rent, mortgage payments, or subscriptions.

Scheduling payments also means you can align them with your paydays, ensuring that your bills are covered when you have the funds available. Whether you prefer to manually initiate a payment or automate it entirely, the flexibility to customize your approach makes it easier to stay on top of your finances using Huntington Online Banking.

Set Reminders for Payments with Huntington Online Banking

Never miss another bill with Huntington Online Banking’s Bill Pay feature that includes the option to set reminders. You’ll receive alerts before your bills are due, ensuring that you’re always prepared. These reminders can be sent via text, email, or push notifications, so you have plenty of time to take action and avoid late fees.

Whether it’s a reminder for an upcoming scheduled payment or a notification that your automatic payment is processing, these reminders keep you informed and organized through Huntington Online Banking.

Receive E-Bills Directly in Your Huntington Online Banking Account

Huntington’s Bill Pay feature also allows you to receive e-bills directly in your Huntington Online Banking account. This is a convenient way to manage and view your bills without having to worry about paper clutter.

E-bills are the digital version of your paper bills and can be easily accessed and paid through your account. They also allow for secure, encrypted delivery, reducing the risk of identity theft or paper-based fraud.

Additionally, many companies offer discounts for opting to receive e-bills, so you can potentially save money just by making the switch from paper to digital bills.

Why It Matters for Huntington Online Banking Users

Huntington Online Banking’s Bill Pay is an essential tool for anyone looking to simplify their finances and avoid the stress of late payments. By having all your recurring bills in one place, along with the ability to schedule, automate, and receive reminders, this feature saves you time and ensures you never miss an important payment.

Main Benefits

- Seamless Experience: Pay all your bills in one place without needing to visit multiple websites.

- Scheduled and Automatic Payments: Set payments in advance to be made on time every month.

- Payment Reminders: Receive alerts to ensure you never forget a due date.

- E-Bills: Receive and view your bills directly in your Huntington Online Banking account.

With Huntington Online Banking Bill Pay, managing your finances has never been easier. It provides the tools and flexibility needed to handle your bills in a secure and efficient way, making your life just a little bit easier.

Feature 4: Account Alerts

In today’s fast-paced world, staying on top of your account activity is more important than ever. Huntington Online Banking’s Account Alerts feature ensures that you’re always informed about important transactions and account activity. These customizable alerts provide you with real-time notifications, helping you stay on top of your finances and avoid potential issues before they arise.

Customize Alerts to Fit Your Needs

One of the standout features of Huntington Online Banking Account Alerts is the ability to customize them to suit your needs. Whether you want to be notified about a low balance, large transactions, or unusual activity, you have full control over the types of alerts you receive.

Also Read : What is Global Entry and How Does It Work?

This allows you to tailor your alerts based on your personal preferences and priorities, ensuring that you’re always in the loop regarding your account.

For instance, if you want to be notified when your balance falls below a certain amount, simply set up an alert to trigger when your account balance dips below that threshold. Similarly, you can receive alerts whenever large or suspicious transactions occur, helping you catch any unauthorized charges early on.

Stay on Top of Low Balances

Managing your balance is essential to avoiding fees and keeping your finances in check. With Huntington Online Banking’s Account Alerts, you can set up notifications for when your balance is getting low. These notifications can help you avoid overdraft fees or missed payments, as you’ll have time to transfer funds into your account before things get too tight.

By staying aware of your account balance in real-time, you can plan accordingly and manage your spending more effectively. Huntington Online Banking helps you avoid surprises by giving you the information you need to act before a problem occurs.

Receive Alerts for Large Transactions

Large or unexpected transactions can sometimes be a red flag for fraud or mistakes. With Huntington Online Banking, you can set up alerts to be notified whenever a large transaction takes place.

Whether it’s a purchase, bill payment, or transfer, you’ll receive instant notifications, helping you stay on top of your account activity and quickly spot any suspicious charges.

These alerts add an extra layer of security by helping you detect unauthorized transactions early on. If you notice something out of place, you can immediately take action to protect your account, such as contacting Huntington or freezing your card.

Track Suspicious Activity in Real-Time

Another valuable aspect of Huntington Online Banking Account Alerts is the ability to set up notifications for suspicious activity. Whether it’s a sudden spike in spending or login attempts from unknown devices, these alerts notify you of anything out of the ordinary, providing peace of mind that your account is being closely monitored for signs of fraud.

Real-time alerts allow you to take immediate action if you spot any unusual activity. By staying ahead of potential security issues, you can prevent them from turning into bigger problems.

Helps You Avoid Fees and Manage Your Finances

Beyond security and fraud prevention, Huntington Online Banking Account Alerts also serve as a helpful tool for managing your finances. For example, you can set up reminders to pay your bills on time or track your spending to ensure that you’re staying within your budget.

These proactive alerts help you stay organized and avoid unnecessary fees, ultimately leading to better financial health.

Whether it’s avoiding late fees, monitoring your spending, or staying informed about account activity, Huntington Online Banking’s Account Alerts help you keep your finances in check and make smarter decisions every day.

Key Features

- Customizable Alerts: Tailor alerts to suit your preferences and priorities.

- Low Balance Notifications: Get notified when your balance falls below a certain amount to avoid fees.

- Large Transaction Alerts: Receive notifications about any significant transactions in your account.

- Suspicious Activity Alerts: Stay on top of any unusual activity to detect fraud early.

With Huntington Online Banking Account Alerts, you can stay informed, avoid fees, and protect your account with ease. These alerts empower you to make smarter financial decisions and give you the peace of mind you deserve.

Feature 5: Budgeting Tools

Managing your finances effectively requires more than just checking your balance—it’s about understanding where your money is going and making informed decisions about your spending and savings. Huntington Online Banking’s Budgeting Tools provide you with the necessary features to take control of your finances.

Whether you’re saving for a big purchase, planning for a trip, or simply trying to stick to a budget, these tools make it easier to track and improve your financial habits.

Track Your Spending and Savings

One of the primary functions of Huntington Online Banking’s Budgeting Tools is to help you track both your spending and savings. By categorizing your transactions, you can easily see where your money is going each month. Whether it’s groceries, utilities, or entertainment, you’ll gain a clear understanding of your spending patterns.

Also Read : Top 10 Activities at Sandals Royal Caribbean Private Island

This helps you make better decisions about where to cut back and where you can afford to spend more.

For example, you can track all of your monthly bills, making sure that each category of spending aligns with your budget. If you find that you’re overspending in certain areas, Huntington Online Banking’s Budgeting Tools provide the insights you need to adjust your spending habits accordingly.

Categorize Transactions for Better Control

With Huntington Online Banking, categorizing your transactions is easy. The platform automatically organizes your spending into categories like groceries, dining out, rent, utilities, and more. You can even add custom categories to suit your personal needs.

Having a detailed breakdown of your expenses makes it much easier to spot trends in your spending and take control. For example, if you notice that dining out is eating up a larger portion of your budget than expected, you can take steps to reduce this spending in the future. With Huntington Online Banking’s budgeting tools, you’ll have a full view of your financial activity in one place.

Set Spending Limits for Better Financial Control

Another powerful feature of Huntington Online Banking’s Budgeting Tools is the ability to set spending limits. You can establish a budget for each category of spending and get alerts when you’re close to reaching those limits. For instance, if you set a monthly budget of $300 for groceries, you’ll receive a notification when you’re approaching that amount.

This feature helps you stay accountable to your goals and prevents you from overspending. By setting realistic spending limits, you can stay on track with your budget and avoid unnecessary debt. Huntington Online Banking helps you keep your finances under control with these easy-to-use features.

Monitor Your Progress and Adjust Goals

Tracking your progress is an essential part of the budgeting process, and Huntington Online Banking’s Budgeting Tools allow you to monitor how well you’re sticking to your financial goals. Whether you’re trying to save for a vacation, a new gadget, or an emergency fund, you can track your savings over time and make adjustments to reach your targets faster.

The tool shows you how much progress you’ve made in each category, giving you a clear picture of your finances and motivating you to continue making smart choices. If you fall behind on a particular goal, you can reevaluate and adjust your budget accordingly.

Gain Valuable Insights into Your Financial Habits

One of the most beneficial aspects of Huntington Online Banking’s Budgeting Tools is the ability to gain valuable insights into your financial habits. By reviewing your spending and savings over time, you can identify areas where you might be wasting money or where you could cut back to achieve your financial goals faster.

For example, if your spending in certain categories like entertainment or shopping is consistently high, you can decide whether it’s necessary to adjust those habits. Understanding your financial habits helps you make smarter decisions and stick to your long-term goals.

Key Benefits

- Track Spending and Savings: Gain insights into where your money is going and how much you’re saving.

- Categorize Transactions: Automatically organize transactions into helpful categories to understand your financial patterns.

- Set Spending Limits: Keep your finances under control by setting realistic budgets and receiving alerts when you’re nearing your limits.

- Monitor Progress: Track your progress toward financial goals and adjust as needed to stay on track.

- Identify Areas for Improvement: Use insights from your financial activity to spot areas for improvement and make better decisions.

With Huntington Online Banking’s Budgeting Tools, managing your money becomes easier and more efficient. These features help you take control of your finances, stay on top of your goals, and make smarter decisions with your money. Whether you’re trying to save more or reduce spending, these tools provide the insights you need to succeed.

Feature 6: Person-to-Person Payments

Transferring money to friends, family, or anyone else is often needed in our daily lives, whether it’s to pay for dinner, split a bill, or reimburse a friend. Huntington Online Banking’s Person-to-Person Payments feature makes these transactions easy, secure, and hassle-free.

This service allows you to send money to anyone with an email address or mobile number, making it easier to handle payments without having to deal with cash or checks.

Send Money Easily to Friends, Family, and More

With Huntington Online Banking, sending money to others is as easy as sending a text message or email. All you need is the recipient’s email address or mobile number.

Also Read : How to Choose the Perfect Wooden Dining Chairs for Your Home

Whether you’re paying a friend back for lunch or transferring money to a relative, you can complete these transactions directly from your online banking account. The process is quick, and the money is usually transferred instantly, depending on the recipient’s bank.

This feature saves you time and effort compared to traditional methods like writing checks or going to the bank. With Huntington Online Banking, you can easily manage your person-to-person payments from the comfort of your home or while on the go through the mobile app.

Secure and Reliable Payments

Security is a top priority when it comes to financial transactions, and Huntington Online Banking’s Person-to-Person Payments feature ensures that your money is transferred safely. The service uses advanced encryption and security protocols to protect both the sender and the recipient.

Additionally, Huntington Online Banking takes steps to verify the identity of the recipient, ensuring that your payments reach the correct person. With these security measures in place, you can feel confident that your transactions are safe from fraud or unauthorized access.

Split Bills and Share Expenses Conveniently

One of the best things about Huntington Online Banking’s Person-to-Person Payments is the convenience it offers for splitting bills and sharing expenses. Whether you’re dining out with friends, paying rent, or reimbursing someone for a shared cost, this feature makes it easier than ever. Simply send the exact amount to the person you owe, and you’re done.

This feature is perfect for group activities or situations where multiple people need to pay for something together. Instead of worrying about collecting cash or making sure everyone has paid their share, Huntington Online Banking simplifies the process by allowing you to send and receive payments instantly.

Pay Rent, Reimburse Expenses, and More

Huntington Online Banking’s Person-to-Person Payments can also be used for recurring payments like rent or other monthly expenses. If you need to pay your landlord or reimburse a friend for something you shared, you can do so quickly and easily. The money is transferred right from your bank account to theirs, without the need for physical checks or cash.

This is especially helpful for those who prefer electronic payments over traditional methods. It’s also great for managing shared expenses among roommates, family members, or friends, as it ensures everyone pays their fair share.

Key Benefits

- Send Money Instantly: Transfer money quickly to anyone using their email address or mobile number.

- Secure and Safe: Enjoy peace of mind with secure, encrypted transactions.

- Split Bills Easily: Conveniently send payments for shared expenses or group purchases.

- Pay Rent and Reimburse Expenses: Use the feature to handle monthly bills, rent, or reimburse friends and family.

With Huntington Online Banking’s Person-to-Person Payments, managing money between friends, family, and others has never been easier. The service provides a secure and convenient way to handle everyday transactions, making it perfect for splitting bills, paying rent, or sending money for any occasion.

No more worrying about cash or checks—just send the payment directly from your account with a few simple taps or clicks.

Feature 7: Account Aggregation

Managing your finances across multiple banks and institutions can be complicated. You may have accounts at different banks, credit unions, and even investment platforms, which means you have to check each one separately to get a complete picture of your financial situation.

Fortunately, Huntington Online Banking offers Account Aggregation, a powerful feature that lets you consolidate all your accounts in one place. This tool simplifies your financial management by bringing together your balances, transactions, and other account details from various institutions, giving you a comprehensive view of your finances.

Consolidate Accounts from Multiple Institutions

Huntington Online Banking’s Account Aggregation feature enables you to connect and view your accounts from other financial institutions alongside your Huntington account. Whether you have checking, savings, or investment accounts with other banks or credit unions, you can easily integrate them into your online banking dashboard.

Also Read : 10 Ways the Color Psychology in Interior Design Enhances Mood

This means you no longer have to log into multiple accounts or switch between different apps to see your balances and transaction histories.

Instead of juggling multiple websites or apps, you can manage everything from one central location. This consolidation makes it easier to stay organized and on top of your finances, helping you make informed decisions about your money.

View Balances and Transactions for External Accounts

Once your external accounts are linked, Huntington Online Banking will display your balances and transaction histories from those accounts within your online banking platform. Whether you’re monitoring your savings account at another bank or tracking your credit card spending, everything will be accessible in real-time from the same dashboard.

This feature helps you avoid the need to go back and forth between various banking portals to check account details. Instead, all of your financial activity is streamlined, giving you immediate insight into your cash flow and spending habits.

Simplify Financial Management with a Comprehensive View

Having all your accounts in one place through Huntington Online Banking’s Account Aggregation feature simplifies financial management. You won’t have to spend time manually tracking balances or transactions for each of your accounts.

By viewing all your account information in one place, you can more easily track your spending, monitor your savings goals, and make better financial decisions.

This comprehensive view helps you stay organized and aware of where your money is going, even if it’s spread across different institutions. You can see all your assets, liabilities, and transactions at a glance, making it easier to manage your overall financial health.

Manage Your Finances with Ease

By consolidating your financial information in Huntington Online Banking, you can manage your finances with ease. Whether you’re planning for big expenses, saving for a major purchase, or simply checking your balances, having everything in one place reduces the effort required to stay on top of your money.

This streamlined approach helps you track your progress toward financial goals more efficiently, as you can see all your accounts’ information without switching between platforms.

Key Benefits

- Consolidate Accounts: View balances and transaction details for accounts held at other banks, credit unions, or financial institutions.

- Simplified Financial Management: Keep all your accounts in one place for easier monitoring and decision-making.

- Comprehensive View: Get an overview of your financial situation, including all assets and liabilities, at a glance.

- Time-Saving Convenience: Access all your account details from one platform, saving time and effort.

With Huntington Online Banking’s Account Aggregation, managing your finances becomes more efficient and less stressful. This feature allows you to see all your financial information in one place, helping you stay on top of your money, set realistic goals, and make informed decisions about your financial future.

Feature 8: Secure Message Center

When it comes to managing your finances online, security and privacy are paramount. Huntington Online Banking provides a Secure Message Center that ensures you can communicate safely with their customer support team for any banking needs or inquiries. This feature allows you to send messages, ask questions, and provide feedback all within the secure environment of your online banking platform.

Communicate Securely with Huntington’s Customer Support Team

With Huntington Online Banking’s Secure Message Center, you can easily reach out to customer support without compromising your personal or financial information. Whether you need help with a transaction, have a question about your account, or require assistance with any banking service, you can send your message directly through the platform.

This ensures that all your communications are encrypted and protected from unauthorized access, making it a safe way to resolve issues and get the help you need without ever leaving your online banking account.

Send Inquiries, Request Services, or Provide Feedback

The Secure Message Center allows you to do more than just ask questions. If you need specific services, such as requesting a new checkbook, changing account settings, or reporting a lost card, you can easily initiate these requests through the secure messaging system.

Additionally, if you want to provide feedback or suggestions for improving services, the message center is the perfect channel to communicate directly with Huntington’s team.

This feature not only enhances your overall banking experience but also ensures that all sensitive details shared in the process are kept private. No need for external emails or phone calls—everything can be handled securely within your Huntington Online Banking account.

Ensure the Privacy and Confidentiality of Your Communications

One of the key advantages of using Huntington Online Banking’s Secure Message Center is the high level of privacy and confidentiality it provides. All messages sent and received are securely encrypted, protecting your personal information from potential threats.

Unlike sending unencrypted emails or making phone calls that could be intercepted, the Secure Message Center guarantees that all your communications with customer support are kept safe.

This level of security gives you peace of mind when discussing sensitive banking matters, whether it’s about your account details, financial transactions, or other personal inquiries. Your privacy is always a top priority in Huntington Online Banking.

Key Benefits at a Glance

- Secure Communication: Send and receive messages to customer support with encryption to protect your information.

- Versatile Use: Inquire about services, request account changes, and provide feedback through the message center.

- Privacy and Confidentiality: Ensure that all sensitive communications remain safe and private, free from unauthorized access.

- Convenient Access: Communicate directly within your Huntington Online Banking account without the need for external tools or platforms.

The Secure Message Center is a vital feature of Huntington Online Banking, offering a convenient and safe way to interact with customer support. Whether you have questions about your account, need assistance, or wish to share feedback, you can do so securely, knowing that your communications are protected.

Feature 9: eStatements

In today’s digital age, managing your financial records online is not only more convenient, but it’s also better for the environment. Huntington Online Banking offers eStatements, allowing you to receive and access your account statements electronically. This feature provides a more efficient and eco-friendly way to keep track of your finances while reducing paper clutter.

Receive and Access Your Account Statements Electronically

With Huntington Online Banking’s eStatements, you can access your account statements directly through the online banking platform. Instead of waiting for paper statements to arrive in the mail, you’ll receive your account details electronically, often as soon as the statement is ready.

This gives you faster access to your financial information without relying on traditional mail delivery.

Simply log in to your Huntington Online Banking account to view and download your statements at your convenience. This feature makes it easy to stay on top of your finances, whether you’re checking on recent transactions, reviewing monthly balances, or preparing for tax season.

Reduce Paper Clutter and Access Statements Anytime, Anywhere

One of the major benefits of eStatements is the ability to eliminate paper clutter. With traditional paper statements, you often end up with piles of paperwork that take up space and are difficult to organize.

Huntington Online Banking allows you to access your statements digitally, making it easier to manage your financial records and reducing unnecessary paper waste.

Moreover, eStatements are accessible from anywhere, whether you’re at home, at work, or on the go. You don’t need to wait for physical mail, and you can view your statements at any time from your computer or mobile device. This level of accessibility ensures you can stay informed about your financial situation no matter where you are.

Convenient Storage and Easy Retrieval of Financial Records

Huntington Online Banking’s eStatements feature also provides convenient storage for your financial records. Once you’ve accessed your eStatement, you can save it to your device or cloud storage for easy retrieval later.

The digital format makes it simple to organize your statements by year, month, or account type, allowing you to quickly find the exact document you need whenever you need it.

The easy-to-search digital format also makes it simple to locate specific transactions or review your account activity over time. You can access your entire account history from your Huntington Online Banking dashboard, making it a breeze to track spending patterns, verify past transactions, or keep your financial records up to date.

Key Benefits

- Electronic Access: Receive your account statements digitally for faster, more convenient access.

- Reduce Paper Clutter: Eliminate the need for physical paper statements, helping reduce clutter and waste.

- Access Anytime, Anywhere: View your eStatements at any time and from anywhere using Huntington Online Banking.

- Convenient Storage: Easily store and organize your statements for future reference, with the ability to search and retrieve documents quickly.

With Huntington Online Banking’s eStatements, you gain the advantage of easy, paper-free access to your account statements. This feature not only saves time but also makes it easier to organize and access your financial records whenever you need them.

Feature 10: Overdraft Protection

Overdraft fees can quickly add up, leaving you with unexpected costs and frustration. Fortunately, Huntington Online Banking offers robust Overdraft Protection options to help you avoid these fees and safeguard your accounts.

This feature provides you with peace of mind knowing that your accounts are protected from insufficient funds, ensuring that you can manage your finances with confidence.

Safeguard Your Accounts from Overdraft Fees

With Huntington Online Banking’s Overdraft Protection, you can ensure that your checking account will not be overdrawn due to accidental overspending. When you link your checking account to other accounts, such as a savings account or a line of credit, Huntington Online Banking can automatically cover any shortfalls.

This means that even if you accidentally spend more than you have in your checking account, the system will draw from your linked account to prevent overdraft charges.

This protection helps you avoid costly fees and ensures that your transactions go through smoothly, even when you have less than expected in your account.

Link Your Checking Account to a Savings Account or Line of Credit

One of the great features of Huntington Online Banking’s Overdraft Protection is the ability to link your checking account to a Huntington savings account or a line of credit.

If you don’t have enough funds in your checking account, the system will automatically pull the required amount from your linked account or credit line. This way, you won’t have to worry about a declined transaction or unnecessary fees.

You have the flexibility to choose the method that works best for you, whether you prefer to link a savings account for smaller transactions or set up a line of credit for larger coverage. The setup process is easy and can be done directly from your Huntington Online Banking dashboard, giving you complete control over how your accounts interact.

Avoid the Hassle and Costs Associated with Overdraft Fees

Huntington Online Banking‘s Overdraft Protection helps you avoid the headache of dealing with bounced checks, declined transactions, or surprise fees. It’s a simple way to manage your accounts and ensure that your payments are processed without additional costs.

By choosing to activate overdraft protection, you are taking proactive steps to protect your financial health and avoid the stress that comes with overdraft charges.

This feature is especially useful if you’re managing multiple payments or making a larger-than-usual purchase and want to ensure that everything goes smoothly. Overdraft protection ensures that your financial transactions will not be interrupted, even if unexpected expenses arise.

Key Benefits

- Protection from Fees: Safeguard your checking account from overdraft fees and the hassle of declined transactions.

- Link to Other Accounts: Easily link your checking account to a savings account or line of credit for automatic coverage.

- Seamless Transfers: Automatically transfer funds from your linked account to cover any shortfalls, ensuring smooth transactions.

- Peace of Mind: Eliminate the worry of unexpected fees or declined payments with the security of overdraft protection.

With Huntington Online Banking‘s Overdraft Protection, you have a reliable safety net that helps you manage your finances with ease and avoid unnecessary fees. This feature adds an extra layer of protection and ensures that your financial activities are always covered, even when things don’t go exactly as planned.

Conclusion

As we’ve explored, Huntington Online Banking offers a variety of powerful and convenient features designed to enhance your banking experience. From the intuitive dashboard that simplifies account management, to the mobile app that provides secure on-the-go access, these features are built with you in mind.

With tools like bill pay, budgeting options, and overdraft protection, Huntington Online Banking helps you manage your finances smoothly and securely.

These features are designed not only to make banking more accessible but also to give you the tools to take control of your financial future. Whether you’re looking to easily track spending, make payments, or protect your accounts from unexpected fees, Huntington Online Banking provides a full suite of services to meet your needs.

By leveraging these features, you can ensure that your financial management is streamlined, secure, and efficient.

We encourage you to explore all that Huntington Online Banking has to offer and take full advantage of these tools to improve your banking experience. Staying informed about the features available to you can make all the difference when it comes to managing your finances.

The more you know, the easier it will be to stay on top of your accounts and avoid unnecessary fees.

Thank you for taking the time to read through these top 10 features of Huntington Online Banking. If you have any questions or need assistance, Huntington is always here to help. Feel free to reach out and get the support you need to make the most of your online banking experience. Happy banking!